Footprint's Fintech Futures:

These are the trends we think will dominate KYC and user onboarding for consumer fintechs in 2026.

We spend all day thinking about how to make user onboarding better. From iterating on new tools to talking to customers day in and day out, I like to think we have a pretty good understanding of the space.

As is the same every year, consumer fintechs will continue to wrestle with the fidelity to friction paradigm. Despite the problem remaining the same, innovation will continue. These are the features we expect to gain traction in '26 and further decrease friction and fraud for fintechs.

What's In

Intelligent Customization

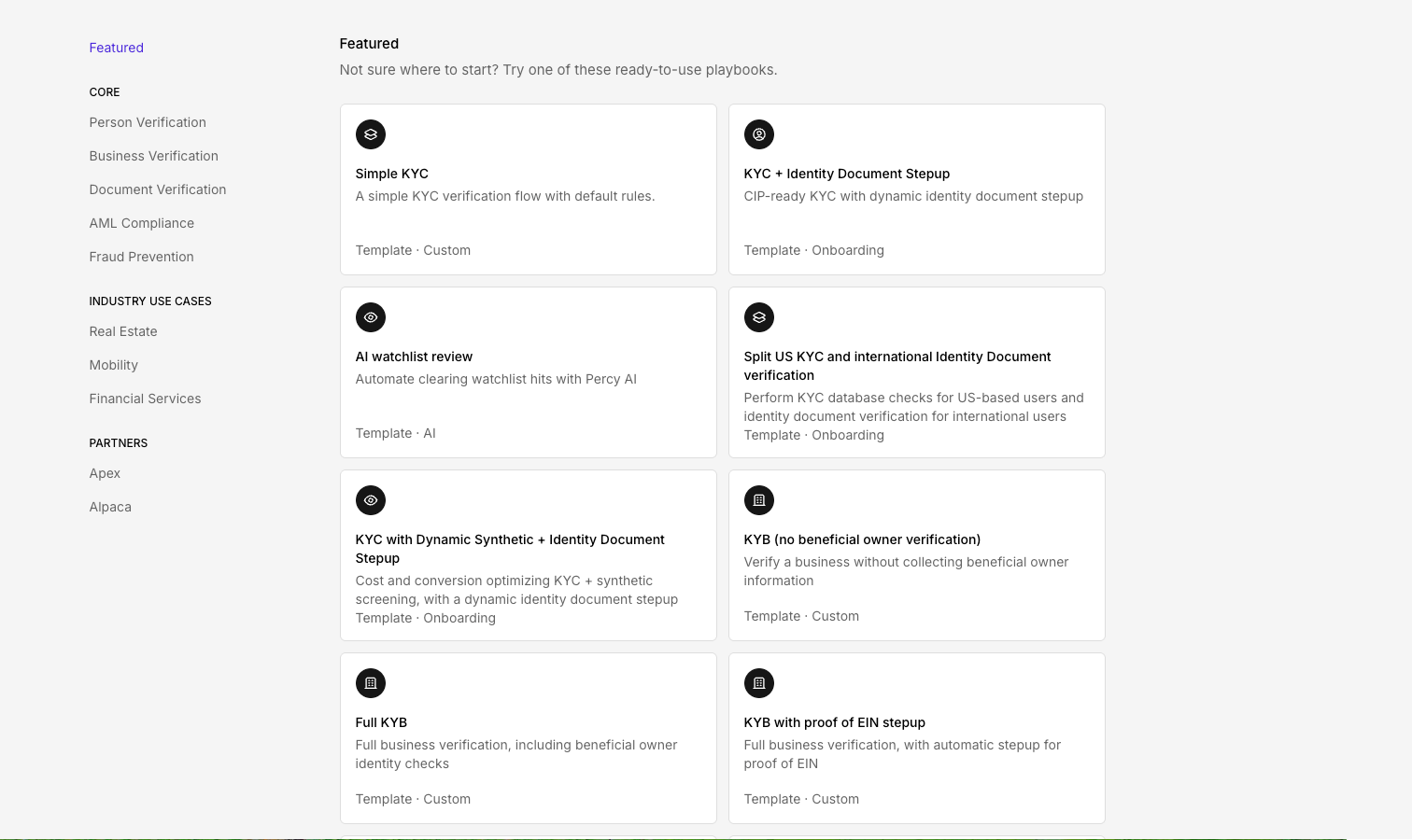

There's no one-size-fits-all KYC flow: fintechs serve different customers and partner with banks that each impose their own CIP requirements. At the same time, customization for its own sake creates unnecessary friction. The ideal onboarding solution is flexible enough to adapt, fully white-labeled, and works out of the box, without requiring a dedicated SWE or external implementation engineer.

That's why we're bullish on recipes: prebuilt onboarding flows that support configurable rules and external API calls. They let teams incorporate custom logic and third-party data into decisioning, without the complexity of stitching together multiple tools or maintaining bespoke integrations.

Pre-fill

In 2025, according to this report by Guidehouse, an approximated 40-70% of users abandoned onboarding for fintechs midway. In June of 2025, FinCEN allowed banks to collect TINs from external sources rather than from users themselves, establishing greater legitimacy for one-click KYC and pre-fill. If adopted and utilized intelligently, we predict that offering users the option to leverage pre-fill and fully onboard by just inputting their name and phone number would drastically decrease abandonment rates.

Step-Ups

Although fraud prevention often dominates onboarding discussions, bad actors represent a tiny fraction of users. Most customers are low risk and treating them like suspects introduces unnecessary friction.

Footprint’s onboarding engine is built around a simple principle: zero friction for low-risk users, and targeted step-ups for higher-risk ones. Instead of forcing everyone through the same rigid flow, we dynamically increase friction only when risk signals justify it.

The calculus is straightforward: good users shouldn’t be penalized. They should be able to onboard in seconds, while higher-risk users are seamlessly guided through additional checks to prove their identity without compromising compliance or conversion. Ultimately, we expect all KYC providers to adopt a similar flexibility in ‘26.

What's Out

Manual Review

Although it's been touted as the silver bullet for all problems since the launch of GPT 3.5 in 2022, we think this is actually the year that mass adoption of AI tools for compliance become mainstream, allowing for more robust SOPs where every step is completed perfectly 100% of the time.

An enormous amount of time is spent by humans reviewing documents, resolving AML false positives, and conducting research on high-risk users. AI agents can perform these tasks more comprehensively, checking more fraud signals and conducting more thorough research, enabling teams to catch more fraud while massively cutting manual review volume.

Arbitrary Confidence Scores

What is the difference between a user with a risk score of 64 and a 59? The truth is I don't know, and honestly nobody does. A consumer fintech simply wants to know if a user is a bad actor or not.

That's why the era of benchmarking decisions based on confidence scores is out and should be replaced with clear recommendations based on user behavior or specific rule-based logic. A user should be prompted to upload an identity document if they are deemed as a potentially risky user, not simply labeled a "67" and sent to a human to interpret that score.