SOP-driven intelligence

Upload your SOPs. We translate them into agent workflows automatically. Same procedures, faster execution, perfect consistency.

Investigations, disputes, reviews, and any risk workflow at machine speed.

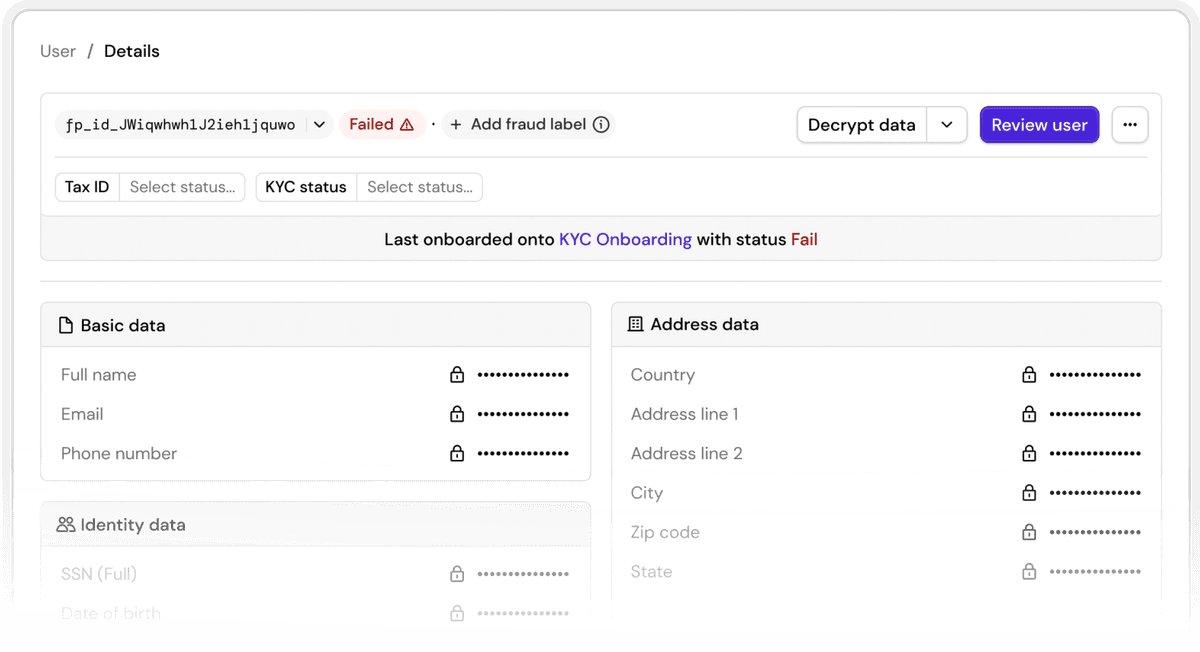

Percy agents run investigations. Pull data. Check sanctions. Assess risk. Write the memo. All in seconds, not hours.

Upload your SOPs. We translate them into agent workflows automatically. Same procedures, faster execution, perfect consistency.

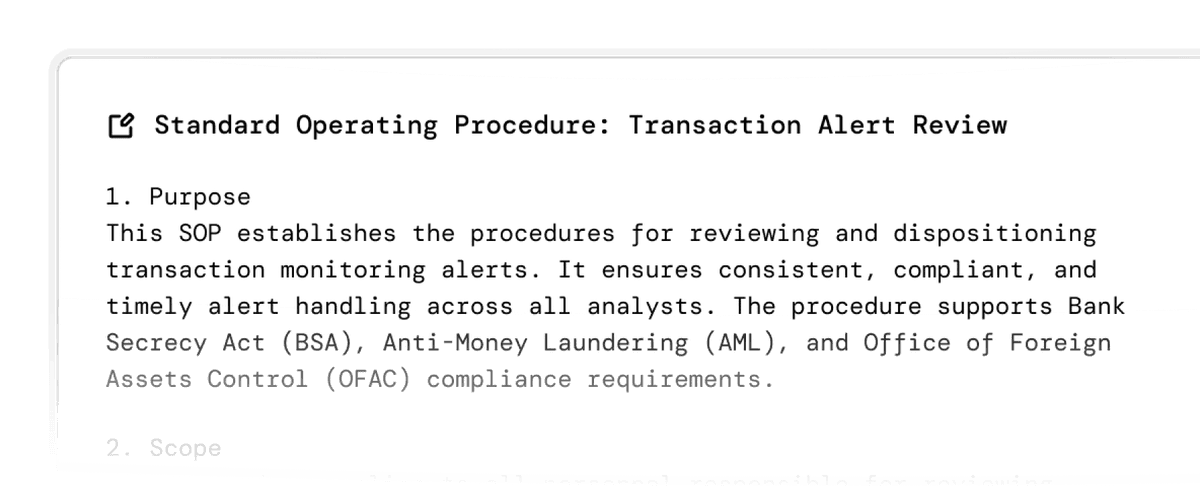

Each agent gets an isolated computer. Write Python scripts, parse documents, iterate on outputs. Agents operate like human analysts with a terminal.

Break tasks into subtasks. Spawn sub-agents that share the same workspace. A week-long EDD investigation completes in minutes.

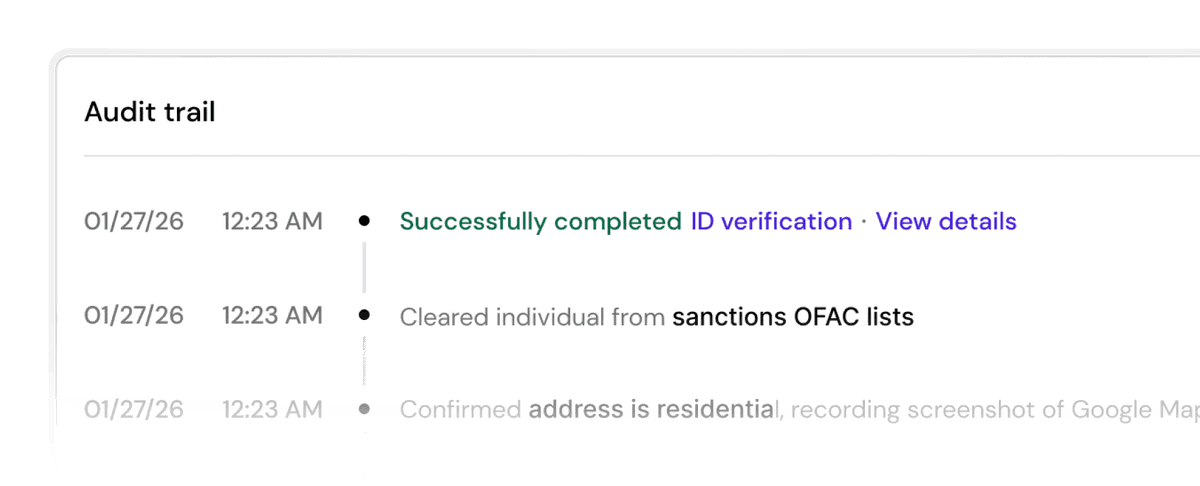

Every step becomes part of the permanent record. Tool calls, commands, reasoning traces. Every decision is reproducible and attributable.

Turn written policies into executable, auditable workflows in seconds, with full traceability and control.

1. Purpose

This SOP establishes the procedures for reviewing and dispositioning transaction monitoring alerts. It ensures consistent, compliant, and timely alert handling across all analysts. The procedure supports Bank Secrecy Act (BSA), Anti-Money Laundering (AML), and Office of Foreign Assets Control (OFAC) compliance requirements.

Document your procedure in natural language. Define what the agent should do step-by-step.

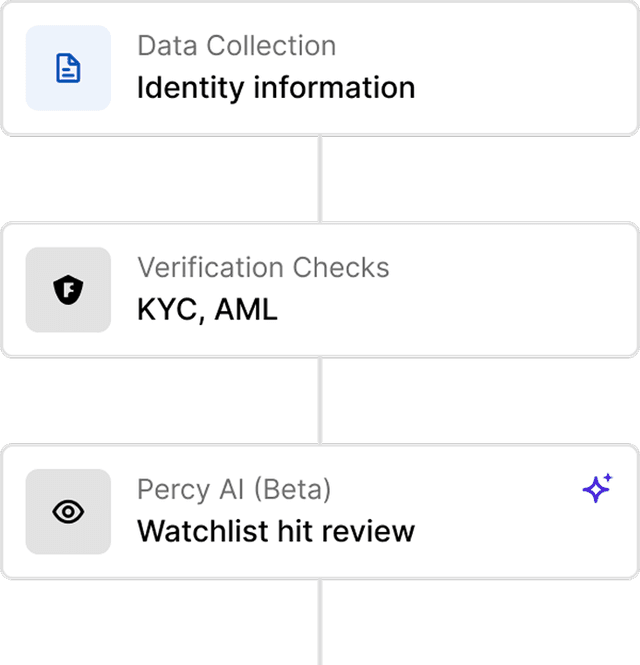

Our compiler parses your text into a structured task graph. Dependencies become edges.

Drop the agent into any Playbook. It inherits all guarantees: encryption, compliance, audit trails.

Each execution spawns an isolated container with everything it needs: SOP, entity data, skill files, a scratchpad for memory, and access to tools, Footprint's contextual risk signals, past cases, and shared agent memory.

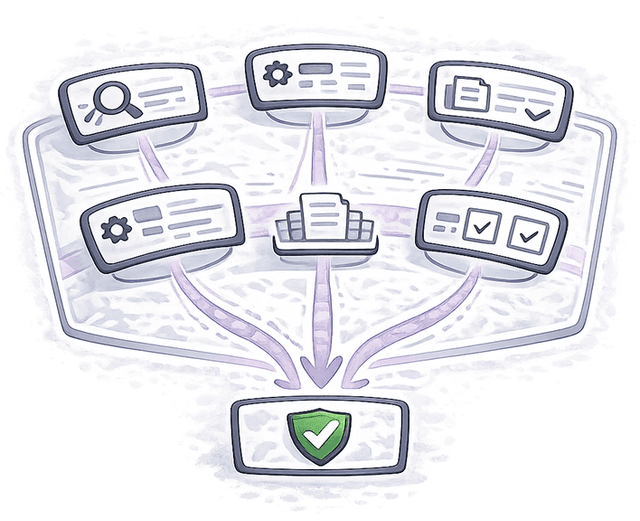

Percy comes ready to run your core compliance and risk operations.

Verify identity, assess customer risk, and maintain ongoing due diligence.

Perform deeper investigations for high-risk customers with explainable decisions.

Assess business entities, ownership structures, and associated risk.

Screen against sanctions, PEPs, watchlists, and adverse media sources.

Detect anomalies, synthetic identity, and abusive behavior patterns.

Investigate suspicious activity across transactions, entities, and behaviors.

Review disputes and claims, gather evidence, and generate defensible outcomes.

Generate audit-ready rationales, SAR narratives, and regulatory filings.

Request missing documentation and track completion in real time.

Drop Percy Agents into any Playbook. Every decision is logged, explainable, and auditable.