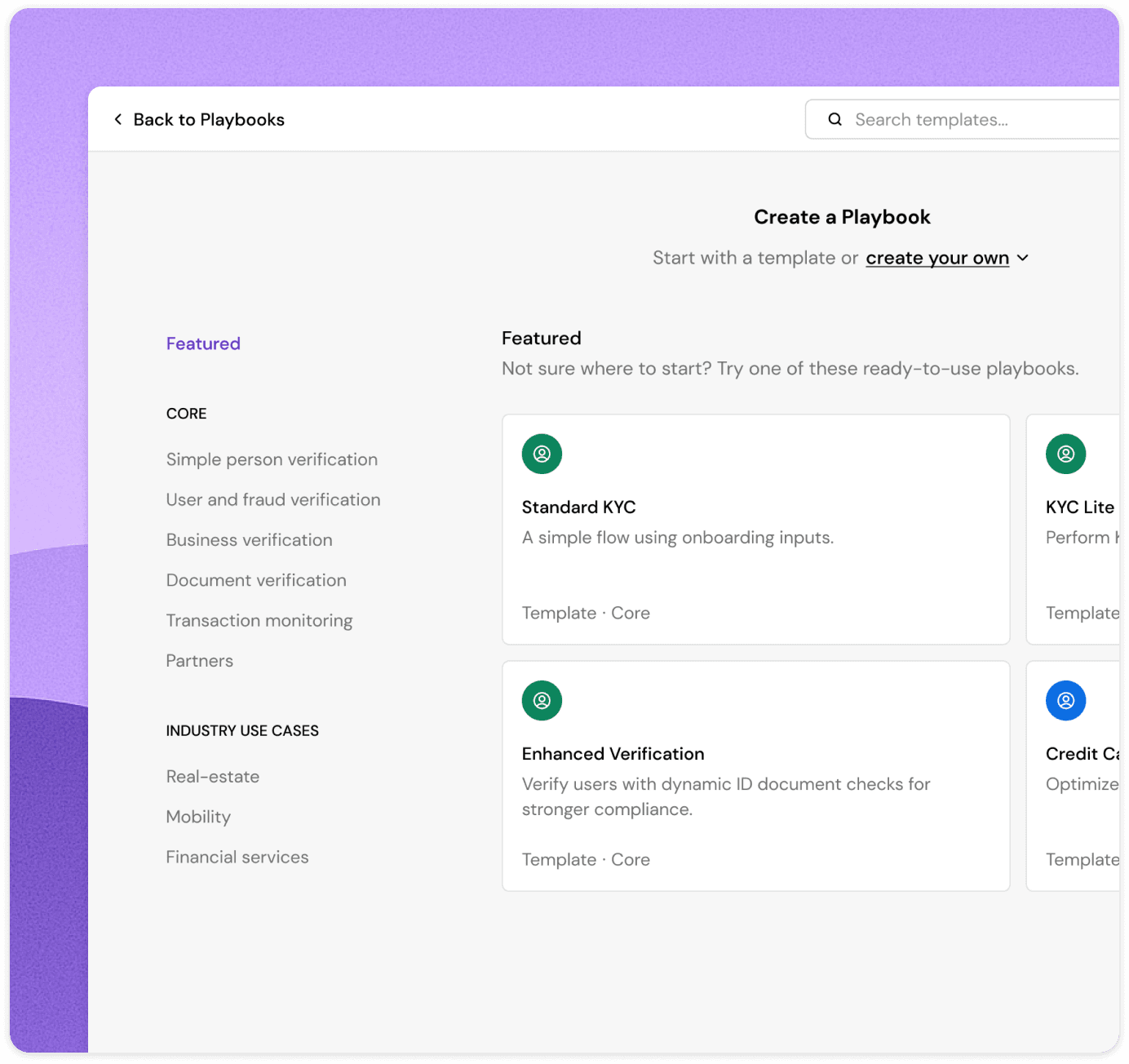

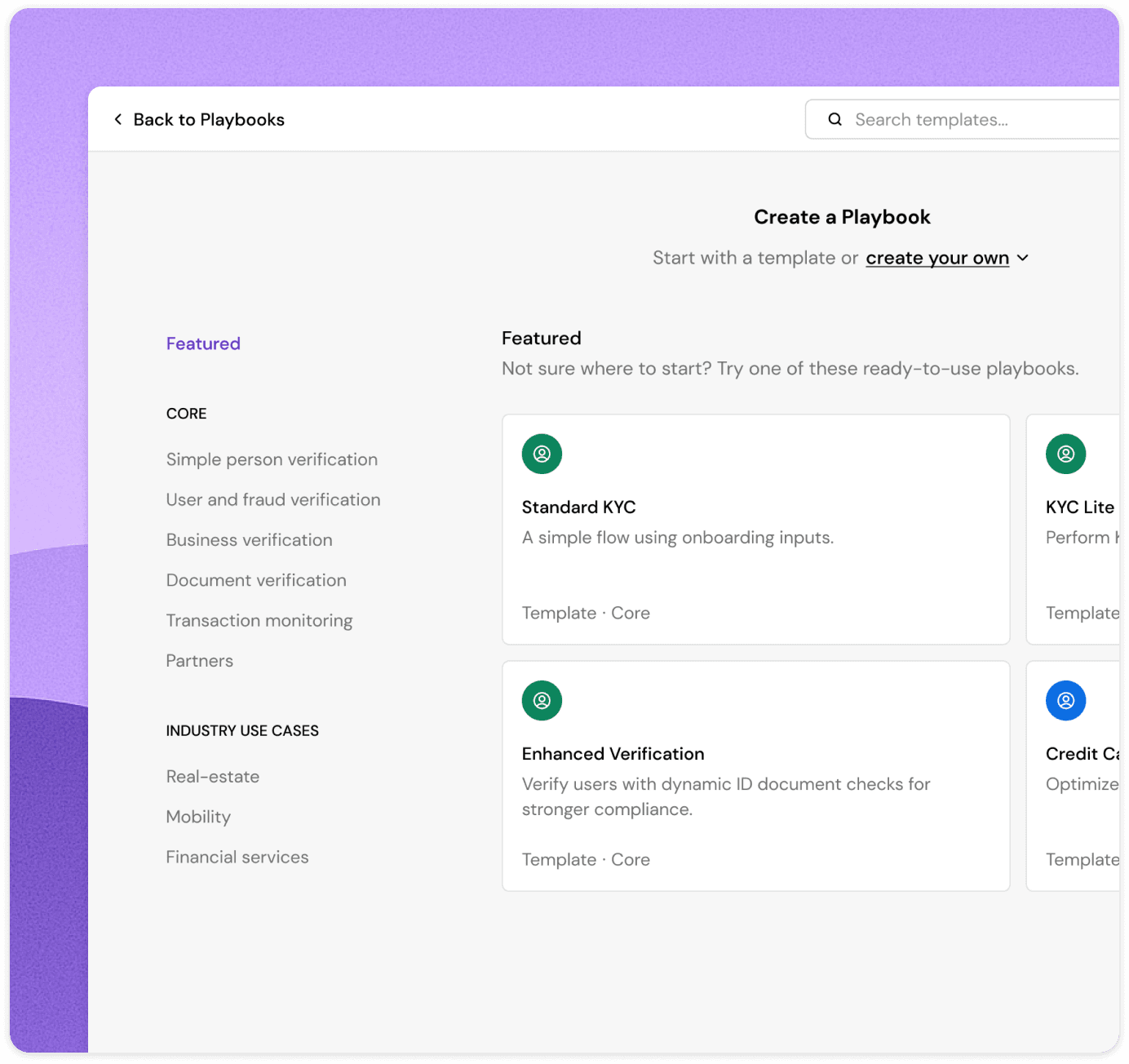

Start with a template

AI-powered onboarding for KYC, KYB, fraud detection, document scanning, and bank linking.

From banks to gaming platforms, leading brands trust Footprint to handle millions of verifications securely.

Supporting identity verification across FIS' ecosystem.

Supporting identity networks for hundreds of banks.

Simplifying KYC, security, and banking for millions of users.

Helping the #1 casino in the App Store reduce fraud.

Onboarding users for a top 10 global payments company

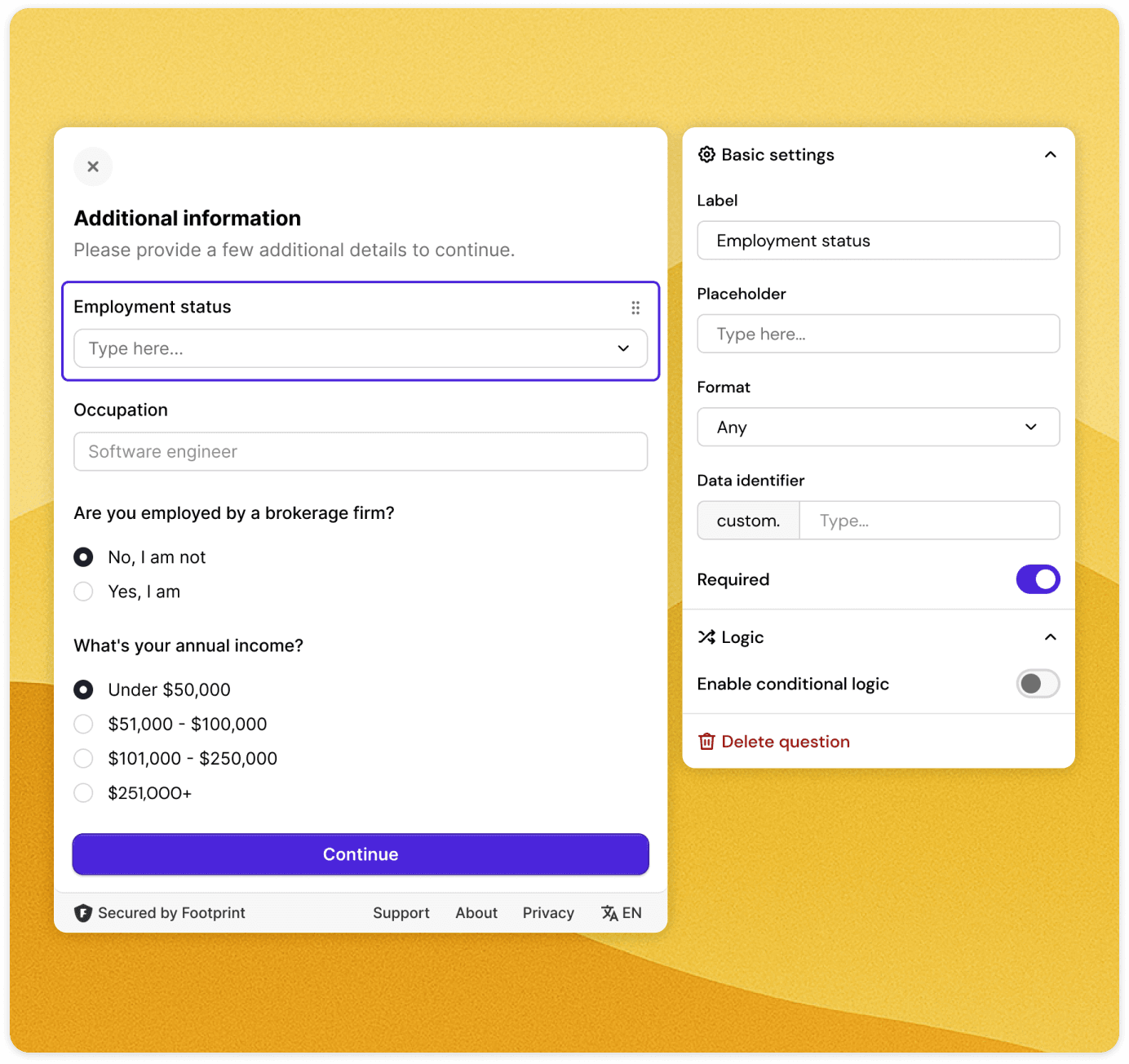

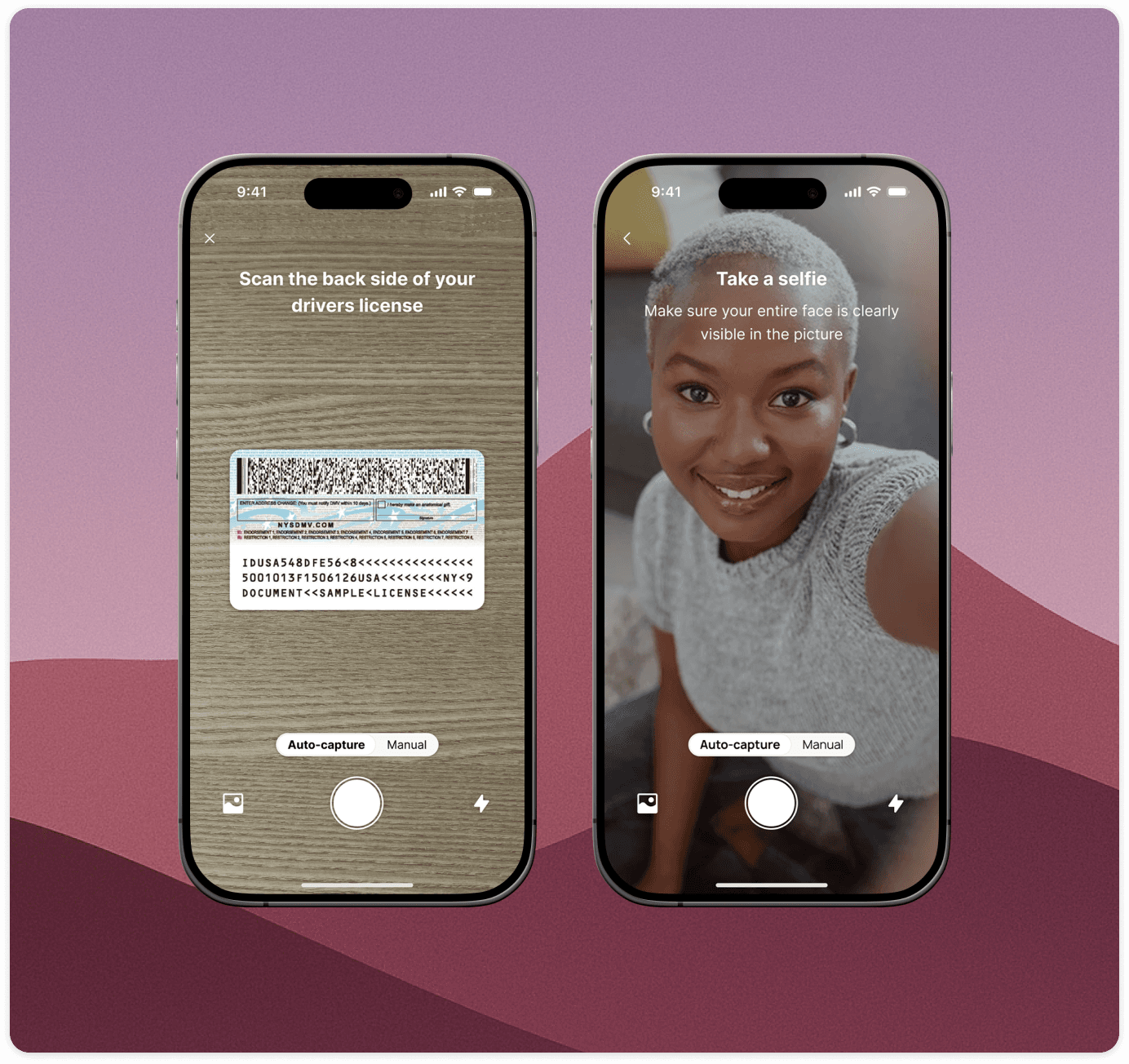

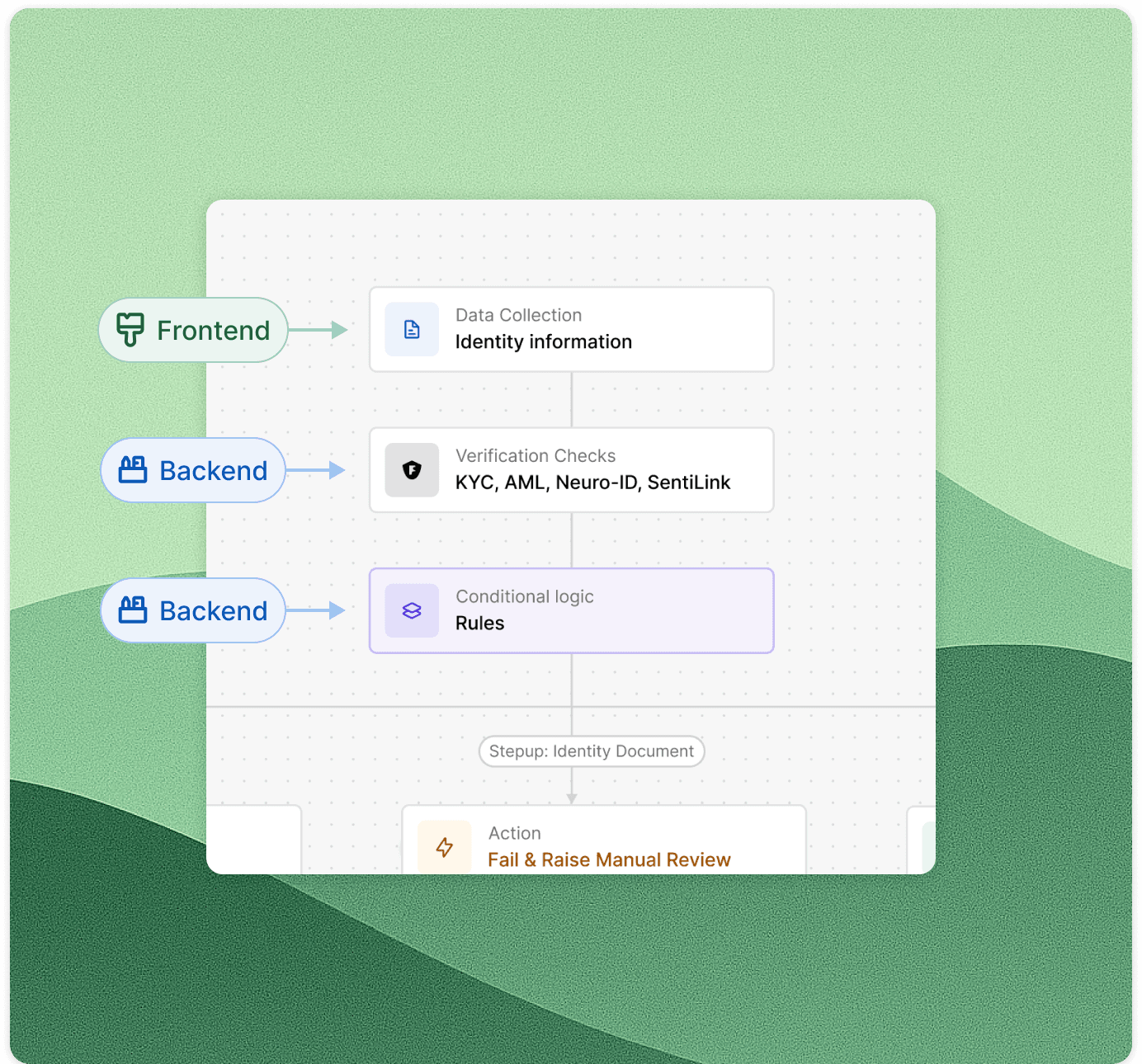

Build smarter, programmable onboarding experiences powered by Footprint's Onboarding Engine.

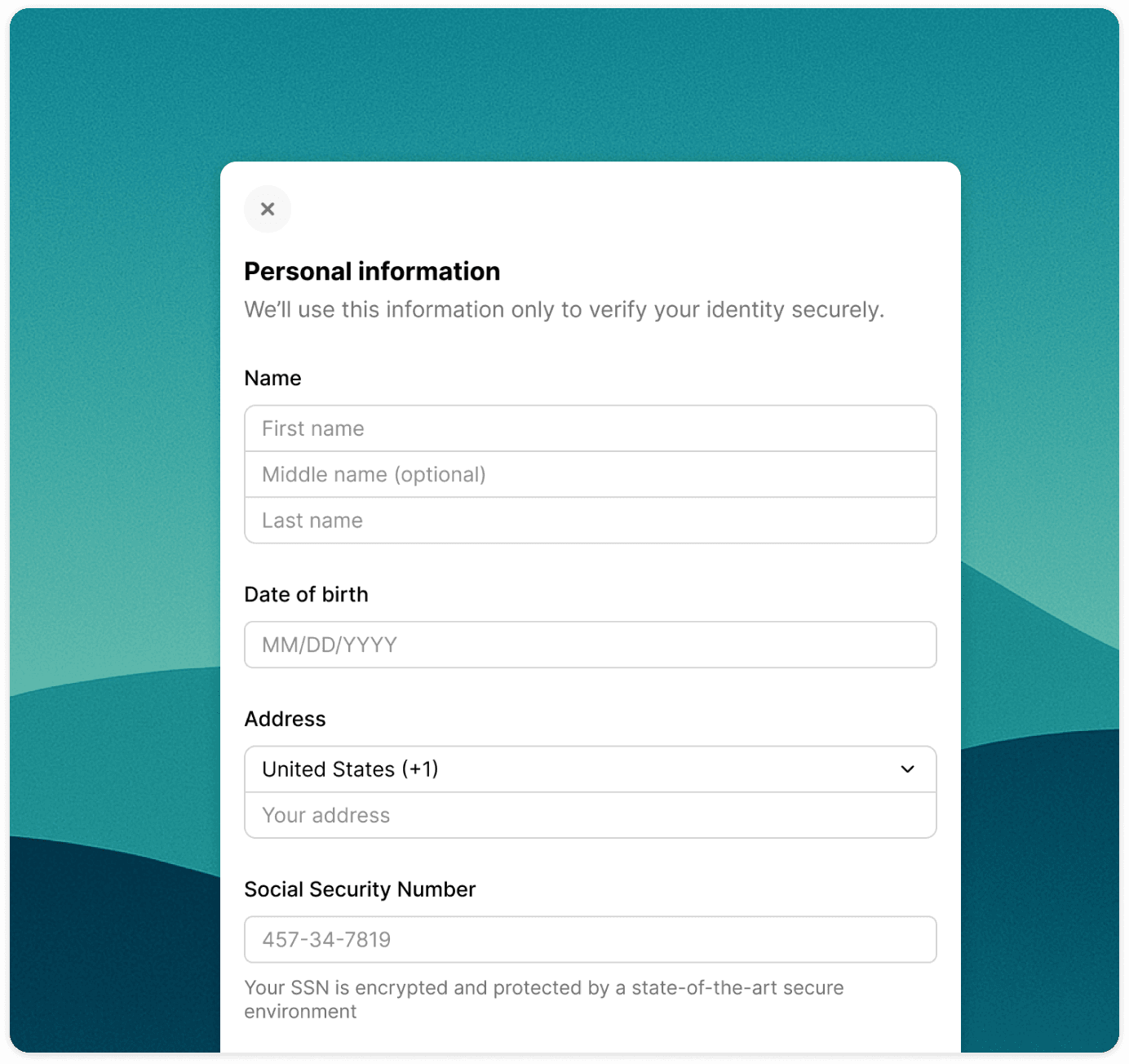

Build seamless, fully customizable onboarding experiences with pixel-perfect UI components crafted for security, scalability, and complete design control.

Enter your phone number to continue.

We'll use this information only to verify your identity securely.

Please provide a few additional details to continue.

Scan this QR code with your phone to continue.

Don't own a smartphone? Continue on desktop

Enter the 6-digit code sent to +1 (350) 571-3910.

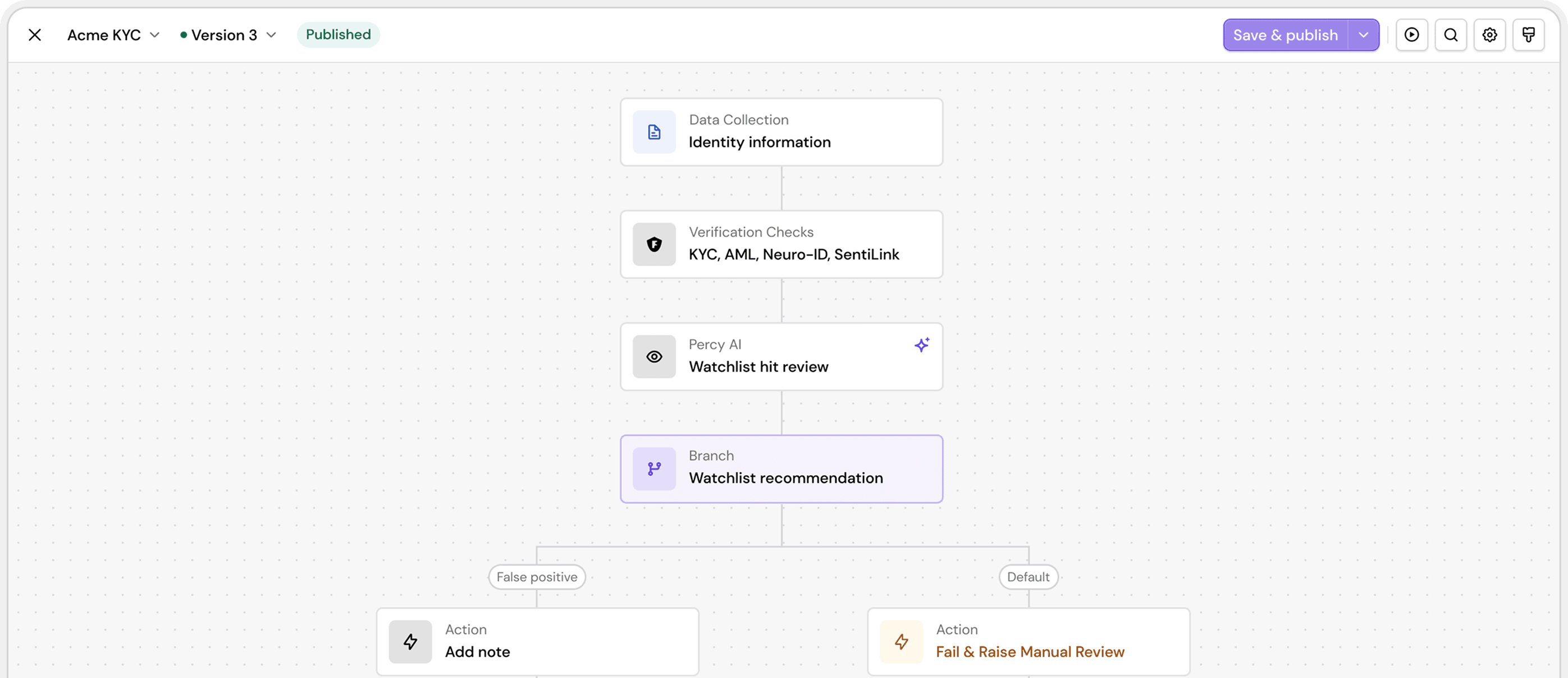

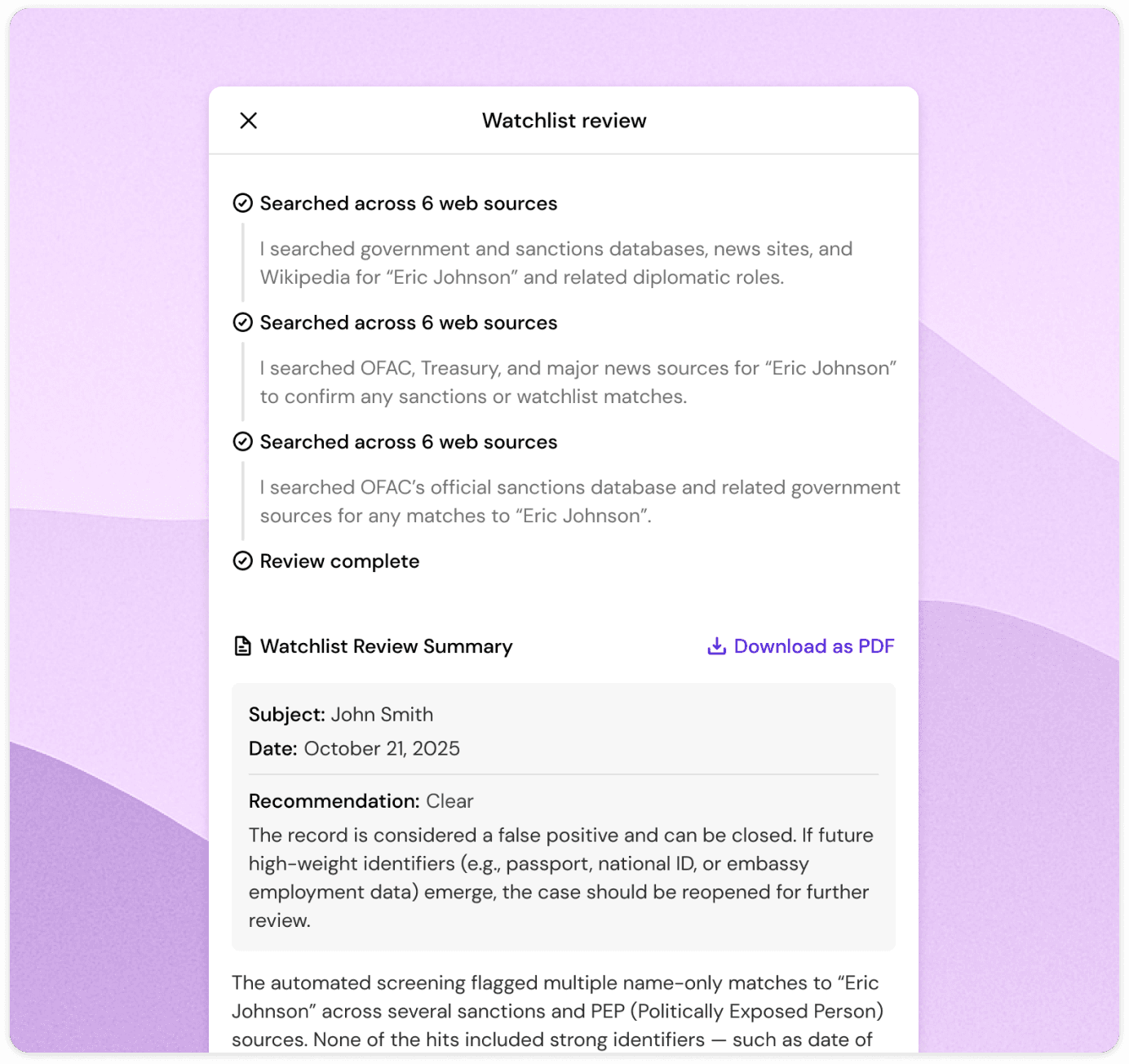

Automate the work you shouldn't be doing. Our AI agents handle watchlist reviews, document extraction, research, and more, freeing your team to focus on high-impact decisions.

Manage manual reviews, prevent fraud, and stay compliant with secure data storage, powerful automation, and real-time insights across every onboarding.

Secure data storage. All identity, financial, and custom data is vaulted and encrypted by default, ensuring complete privacy and compliance.

Case management made easy. Organize manual reviews into queues, set priorities, and monitor progress across teams with ease.

Audit trail. Every verification event is automatically logged, from document collection to outcome, providing a complete, timestamped history for compliance and review.

Advanced reporting. Track decisions, reviews, and watchlist activity with detailed dashboards that help you monitor performance and detect trends in real time.

Actionable onboarding insights. Every onboarding tells a unique story. We cut through the noise and help you make informed decisions.

Device insights. Gain visibility into the devices used during onboarding, including operating system, browser, location, and biometric verification status.

Duplicate account detection. The identity network flags users who attempt to onboard multiple times with different personal information, both within your company and across other organizations.

Our customers share how Footprint helps them streamline onboarding, strengthen compliance, and deliver experiences their customers love.

"Based on experience vetting and partnering with many identity-based techs, partnering with Footprint has been a breath of fresh air. In my product, IDV is critical. I want the best security net possible, configurability, trust in a reliable partner, quick support whenever asked, and a commitment to staying ahead of the bad actors. Footprint is thinking outside the box and doing things other IDV providers should have thought about years ago. Proud to stand side by side with Footprint combatting fraud."

"In an age of heightened compliance born from the importance of bank-direct relationships, Footprint's Identity + Security suite was key in helping us smoothly onboard to our sponsor bank. They offer a world-class product with white-glove support."

"We've cut the average time it takes a renter to open and fund their Whale Security Deposit by ~50%."

"I love how Footprint is able to onboard users while offloading the storage of PII. We're able to access the data we need while leveraging Footprint's secure vaulting for the collection and storage."

"Best integration experience since Stripe."

"Footprint has been a significant improvement to our onboarding + fraud stack. It caught four new fraud cases in its first week live, and the app clip minimizes drop-off during document scanning."